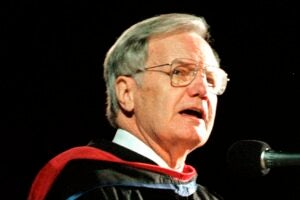

With the economy rapidly deteriorating, thousands of companies are rushing to bankruptcy court in a last-ditch attempt to reorganize and improve their fortunes. Trouble is, their main source of cash is quickly evaporating. Loans to companies in bankruptcy, known as debtor-in-possession financing, have dropped from $7.9 billion in the second quarter of 2008 to $2.9 billion in the fourth quarter, according to data provider Deal Pipeline. “Usually a lot of companies compete” to make debtor-in-possession loans, says Jay L. Westbrook, a law professor at The University of Texas at Austin, but major banks are shying away from these loans because they see better opportunities in the credit market. Meanwhile, the few firms still providing cash to insolvent companies, including GE Capital , Citigroup, and Bank of America, aren’t loosening their purse strings that much. Most only are rolling over existing debt for current customers rather than providing fresh capital–another hurdle for companies to overcome.

Business Week

Loans to Companies in Bankruptcy Dry Up

Jan. 7