Energy — it’s one of those subjects most Americans try not to think about. As long as it’s cheap and easy to fill our tanks and cool our houses, we don’t pay much attention to where energy comes from or how it gets to us.

Maybe that’s why energy policymakers know so little about what Americans think about energy. They hear the opinions of scientists, energy companies and environmental groups. But there’s a shortage of data on the attitudes of consumers — the people who actually use energy and who determine whether policies succeed or fail.

So says Wayne Hoyer, marketing department chair at the McCombs School of Business. When Hoyer looked at existing consumer polls on energy, he saw that they fell into two classes: one-off surveys that gave no sense of how or why attitudes changed over time or surveys sponsored by groups with obvious agendas, such as the Edison Electric Institute or the American Petroleum Institute.

“That creates an opportunity for us,” says Hoyer. On Oct. 19, he and other University of Texas at Austin faculty members unveiled the Energy Poll, developed by the Energy Management and Innovation Center (EMIC) at McCombs. According to Hoyer, the Energy Poll is the first ongoing and nonpartisan measure of how Americans think and behave about energy.

The poll was first suggested by market researcher Peter Zandan, a Texas alumnus who serves on the McCombs School advisory board. The survey questions have been vetted by groups on all sides of energy issues, from energy companies and public officials to academics and environmental groups. “A lot of eyeballs looked at this,” says Hoyer. “It’s important that we have no agenda.”

While there’s no agenda regarding the results, the Energy Poll does fit the agenda for McCombs itself.

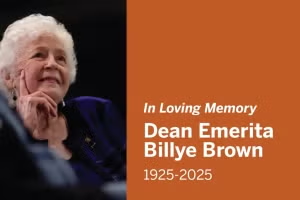

“The Energy Poll is an instrumental part of our strategy to make McCombs known for energy management and innovation,” McCombs School Dean Tom Gilligan says. “To complement our research and teaching, we wanted to develop a tool to help the world understand how consumers feel about energy security, availability and prices.”

Consumers’ Energy ‘Angst’

Judging by the first poll, consumers aren’t feeling optimistic. The 20-minute survey, taken by 3,406 Americans Sept. 14-25, found what Gilligan calls “a general level of angst and insecurity”:

- In dealing with energy issues, 43 percent feel the nation is heading in the wrong direction. Only 14 percent say it’s headed in the right direction.

- In 12 months, 69 percent expect to spend more of their household budgets on energy.

- In 25 years, 41 percent expect our energy situation to be worse than today almost double the 23 percent who expect to be better off.

Fueling consumers’ pessimism is a view that the biggest players in energy policy aren’t playing well. Those surveyed rank the U.S. Congress at the very bottom, with 8 percent satisfied and 71 percent dissatisfied. Local and state governments don’t rate much better.

- Forty-three percent feel the nation is heading in the wrong direction on energy issues, and 41 percent expect our energy situation to be worse in 25 years.

- Consumers blame the government and energy producers for high energy prices.

- Consumers do trust engineers and scientists for energy information, as well as research institutes, colleges and universities.

Traditional energy producers also take a beating. Only 14 percent of respondents are satisfied with energy financiers and only 16 percent with oil and gas companies. Consumers tend to blame those firms for high energy prices, saying prices have more to do with the pricing power of energy companies than with supply and demand.

Which players get the largest votes of public confidence? Engineers and scientists, with a 41 percent satisfaction rating. Wind and solar companies also get thumbs up, along with research institutes, colleges and universities.

“It’s good news for us,” says Hoyer. “Our goal is to be a source of news and information about energy.”

The public, it appears, is hungry for that information. When asked about their level of energy knowledge, 34 percent confess to not being knowledgeable, versus 24 percent who consider themselves knowledgeable. Fully 80 percent want to know more about how to reduce their energy use. A majority also wants to learn more about global and national issues, like consumption of foreign oil, energy efficiency and renewable energy.

Respondents aren’t just looking for information. Many intend to act on it. In the next five years, 38 percent are likely to use “smart meters,” 30 percent to own a hybrid vehicle and 21 percent to put solar panels on their roofs.

Economic Concerns Trump Environmental Concerns

A lesser concern, at least for the time being, is the environmental impact of energy policies. When asked whether they place a higher priority on economic growth or on avoiding harm to the environment, 37 percent choose economic growth, while 33 percent choose the environment.

Given the state of the economy, suggests Gilligan, that’s a surprisingly strong showing for environmental concerns. “It may suggest that when the economy recovers, people will have a much stronger demand for environmental protection again,” he says. “We’ll have the perfect instrument for trying to deduce that effect.”

Indeed, mapping how attitudes change over time is part of EMIC’s vision for the poll. It plans to repeat the survey every six months, with most questions remaining the same. It will use some of the answers to generate an “energy sentiment index” — a single number to sum up consumer confidence about energy, much as the University of Michigan’s Consumer Sentiment Index captures confidence in the overall economy.

The results of the first survey, says Raymond Orbach, director of UT’s Energy Institute, highlight the pitfalls in keeping the public’s confidence. As former undersecretary for science of the U.S. Department of Energy, he says, “I was stunned by the fact that dissatisfaction with state and federal governments, including the Department of Energy, was more than 50 percent.”

That’s just one of many lessons the poll will provide, says Gilligan. “We’re trying to build a data source in a credible and persistent way. Twice yearly, on a recurring basis, we’ll develop a longitudinal database to study how attitudes change. We hope it will be used by anybody involved in management or in energy policy in the energy sector.”

To view more graphs, visit the original Energy Poll story on the Texas Enterprise website.