As if Dallas first responders don’t have enough to worry about, those who have pledged their lives to protect the city now find their own retirement system bleeding funds.

Fearing there will be insufficient assets to pay their promised benefits, Dallas Police and Fire Pension System participants are pulling their money out at unprecedented rates – a virtually unheard of run on a pension fund.

It may be too late to put the Dallas pension system on a sound financial footing without inflicting considerable economic pain on either workers or taxpayers. Similarly, those of states such as Illinois, Connecticut and New Jersey are also beyond salvation.

For others, however, this moment provides a much-needed stimulus for change, albeit one carefully aimed. Otherwise, administrators risk wounding many more public servants as well as taxpayers.

It is tempting to use Dallas’ pension debacle as a case in point as to why governments should eliminate their current plans that promise a defined benefit upon retirement and switch to 401(k) or comparable defined contribution plans favored by most businesses.

This would be a mistake, as an overwhelming percentage of private sector employees with 401(k) plans are fiscally ill-prepared for retirement.

Public employees typically work for lower wages than their private sector counterparts in exchange for a promise of a more financially secure future. With a few common-sense changes, governments can avoid having to renege on that pledge.

First and most significantly, don’t make promises that are unrealistic. Dallas’ immediate problems stem from the deferred retirement option plan (DROP) that is part of its overall pension program.

The city promised participants that they could earn interest at an annual rate of 8 percent on funds in certain specially designated accounts. For the DROP to be financially viable the overall pension program also had to have investment returns at that rate – an obviously difficult target to hit in today’s low-interest environment.

Until recently, it was common among government pension plans to assume they could generate annual investment returns of between 7.5 and 8 percent. Until 2015, Dallas used a rate of 8.5 percent.

Only now are governments starting to reduce that assumption to something more conservative. CalPERS, the giant public pension system of California, recently reduced its estimated investment return rate to 7 percent.

Second, don’t try to juice up yields by getting into the most speculative of investments. Dallas, as of the end of 2015, had 70 percent of its investments in real estate, private equity and various other nontraditional assets and accordingly managed to lose $236 million in 2015.

Third, make the payments to the pension plan that your actuary tells you to make. One of the easiest ways for a government to balance its annual budget is to cut back on its pension contributions.

This approach is especially inviting in years of rising stock prices that allow pension plan investment earnings to exceeded expectations. Unfortunately, what goes up must come down.

As a consequence of persistently contributing less than what would be actuarially recommended, Dallas’ plan is now inadequately funded – assets are only 38 percent of what is actuarially required whereas 80 percent is widely recognized as the standard for fiscal health.

Fourth, don’t offer benefits out of line with conventional employment standards or that can readily be gamed. Many cities not only grant workers full pension benefits after only 20 years of service but also allow them to begin receiving those benefits immediately upon retirement.

Thus, “retirees” in their early 40s may be eligible for full benefits – and are free to continue to work full time for other employers. Similarly, some governments base benefits on total compensation earned in the final year of employment.

Employees are able to “spike” their benefits with sudden bursts of ambition and time-and-a-half overtime pay, and in some cases manage to collect more in pension payments than they did in normal year salary and wages.

Defined benefit plans – the type of plan common to the overwhelming majority of state and local governments – when properly formulated and managed, remain a more efficient and effective means of compensating public employees than 401(k) or comparable defined contribution plans. There is no shortage of governments with fiscally sound defined contribution plans. They should be our models for change, not the self-inflicted carnage now underway in Dallas.

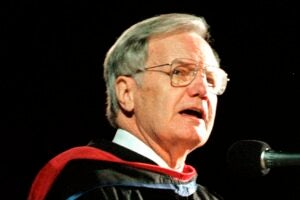

Michael Granof is the Ernst & Young Distinguished Centennial Professor in Accounting at The University of Texas at Austin and a member of the Federal Accounting Standards Advisory Board.

A version of this op-ed appeared in the Dallas Morning News.

To view more op-eds from Texas Perspectives, click here.

Like us on Facebook.